Bom dia traders e investidores!

O dólar acelerou as perdas frente ao real nesta quarta-feira, depois que dados de inflação dos Estados Unidos amplamente em linha com o esperado elevaram as esperanças de que o Federal Reserve possa pausar seu ciclo de aperto monetário.

Às 11:10 (horário de Brasília), o dólar à vista recuava 0,60%, a 4,9562 reais na venda.

Na B3 (BVMF:B3SA3), às 9:59 (horário de Brasília), o contrato de dólar futuro de primeiro vencimento caía 0,88%, a 4,9665 reais.

O índice de preços ao consumidor dos EUA subiu 0,4% no mês passado, após alta de 0,1% em março, informou o Departamento do Trabalho nesta quarta-feira. Nos 12 meses até abril, o índice teve alta de 4,9%, após avançar 5,0% na comparação anual em março.

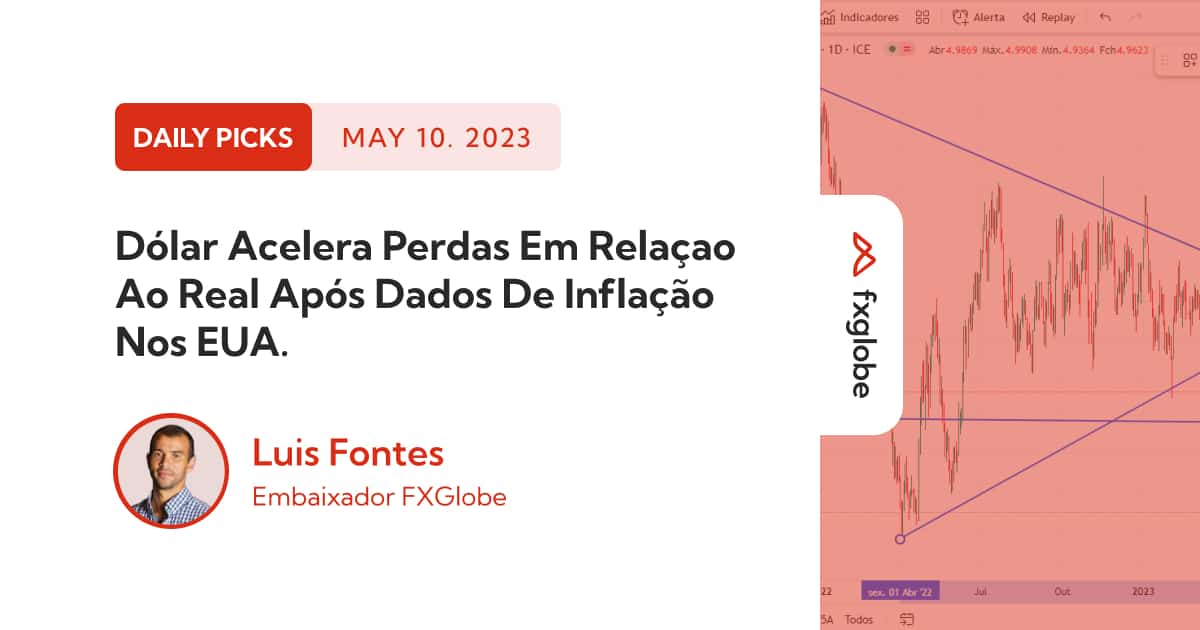

Abaixo dos 5000,00 o dólar em relação ao real vem apresentando oportunidades interessantes para aqueles que desejam montar posição no par de moedas para longo prazo e mesmo para o especulador de curto oportunidades interessantes também estão surgindo, acompanhe o gráfico abaixo.